MONI

Assisting College Students to Manage Their Financial Life

About

Role

MONI is a mobile app experience that aims to help college students track and manage how they spend their money and teach them how to invest in stock market.

UX / Interaction design

User Research

WireFraming

Prototyping

Usability Testing

The Problem Begins With ...

Listening to countless times of complaints “I’m so broke” from my classmates and friends when I was in college made me wonder why college students struggle financially even though 85% are on financial aid and working part-time.

Help college students to manage and

spend their money ?

HOW MIGHT WE ...

THE SOLUTION

Designing an experience that makes it easy for college students to manage and learn how to use their money by creating a budget to keep tracking spending, setting up a financial plan to meet their goals, and learning about stock investment.

BUDGET

Users can set up a budget for their spendings and monitor them in different categories.

SAVING GOAL

Users can set up a financial plan to start saving for specific purposes.

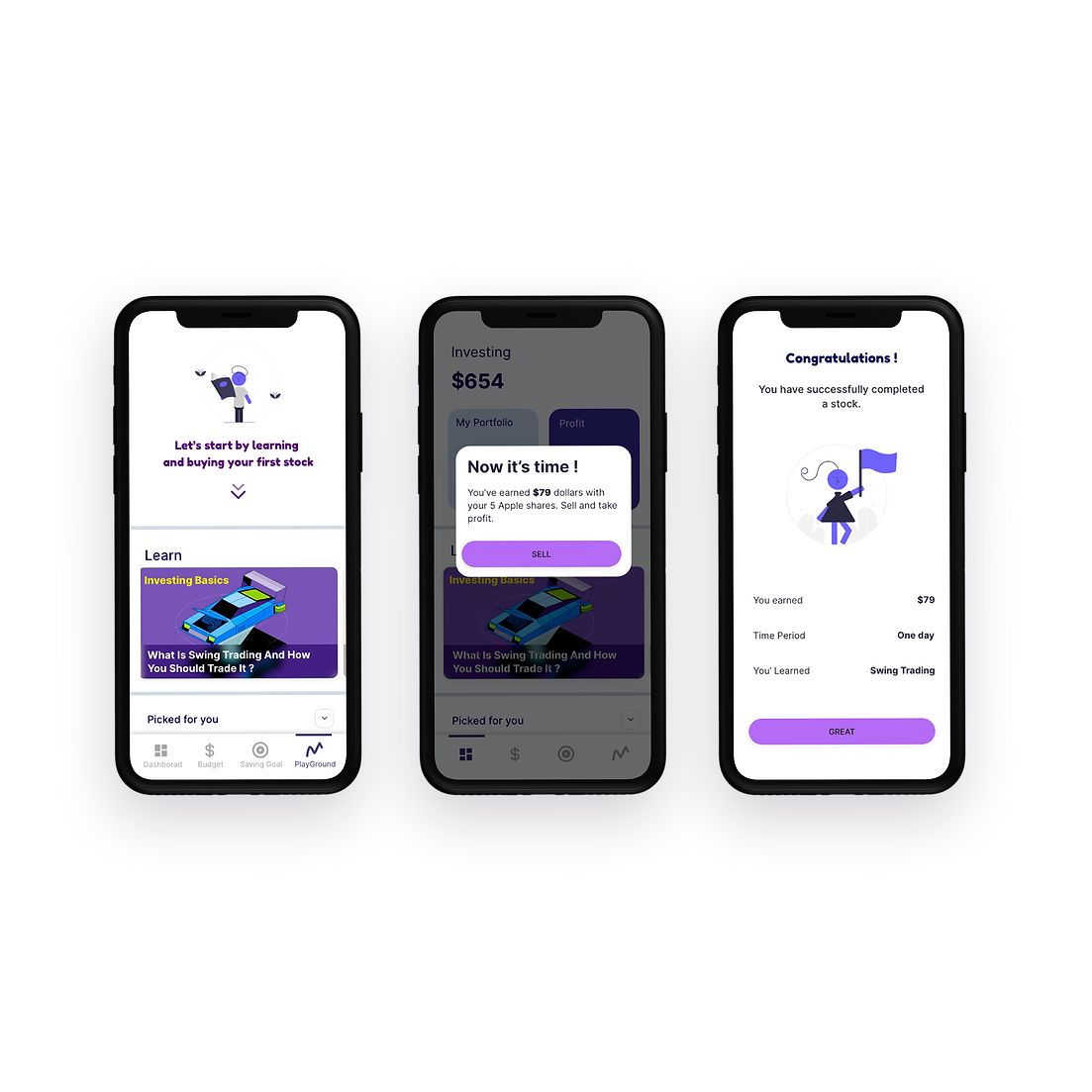

Learn and practice stock investment without risking your own money.

STOCK PLAYGROUND

EARLY ASSUMPTIONS ON WHAT MAKES

COLLEGE STUDENTS GO BROKE.

• College students don’t earn enough money.

• They don’t have a plan on how they should. spend money.

• Most of them have problems dealing with their financial life.

THE RESEARCH

begins

INTERVIEWS

THE

2 weeks

2

2

1

First-Generation students

with financial loans

Non-First-Generation Students

With no financial loans

Student who doesn’t struggle

Financially

I wish I can see my spendings in

categories, so that I don’t spend too

much on certain things.

I’m not struggling financially, but I want to be able to track all my spendings at one place, so I don’t jump around the bank apps.

It would be great if there is a way

To make a plan and save for my financial goals.

I wish I can learn about stock investment so that I don’t blindly try my luck and risk my money.

THE

Synthesis

LEARNING & FINDINGS

• Users want to plan and track their spendings by having a limit

on different categories

• Users want to save for a specific goal, such as paying off student loans or purchasing an expensive item.

• Users want to learn about stock investment, but they are concerned about the risk they need to take.

IDEATION

POSSIBLE FEATURES BASED ON USERS' VOTES

• Budget

Users can set up their spendings and monitor them in different categories.

• Saving Goal

Users can set up a financial plan to start saving for specific purposes.

• Stock Playground

Users can buy and sell stocks in a live market without risking their own money.

USER FLOW

A clear user flow helped me get started with the sketches

for the initial design.

SKETCHES

THE EARLY

User Testing

To test my concepts and assumptions, I turned my sketches into

wireframe prototype on Adobe XD and tested it with 5 participants.

The Testing Goals

• Do users understand the primary purpose of the design ?

• Will users be able set up a budget as well as a saving goal ?

• Will users understand the concept of the Stock Playground?

From the users, I was able to find out what worked and

What didn’t work.

1. Users want to see what’s left on their budget for each category while they spend money.

2. Users want to see a total amount for budget contribution while they are in the process of setting it up.

3. Users are confused if it’s their money to use the StockPlayground .

The biggest challenge that I encountered after the testing

“How can I make the Stock Playground a meaningful and learning experience so it will prepare college students for the stock investment with less potential risk in the future.”

WHY STOCK PLAYGROUND MATTERS ?

20-Year-Old Robinhood Customer Dies by

Suicide After Seeing A $730,000 Negative

Balance.

His final note, filled with anger toward

Robinhood. “I had no clues what I was doing”.

Therefore, I researched and found Robinhood learning as an excellent source to learn about the stock. However, it’s all articles reading, which is not practical at all.

SO, I ASKED

MYSELF AGAIN

How can I implement these learning tips and knowledge into something practical, so college teens can practice and learn about stock investment at the same time?

Introducing learn

This feature helps users to learn about stock investment by doing. “LEARN” will benefit them in long run and reduce the potential physical and mental harm from stock investment.

FINAL DESIGN

THE

STYLE GUIDES

THE

REFLECTION

Unsolved problem

“Is there a better way to stop users from spending when they go over the budget” rather than just simply “send a push notification to let them know” has bugged me for the entire project. First, it’s because the notification might not be as effective, and users might just ignore it or forget about it. Secondly, we can't limit user's freedom to not spend their own money.

A broken gun is better than a working gun

When it comes to Stock Playground, I’m still concerned about the consequences of my design even though I have a good intention of preventing potential harm on users. There is a possibility that some users misunderstand some tips on stock investment and misuse them in the future.